Convenient invoicing and accounting of individual activities:

- Free invoicing

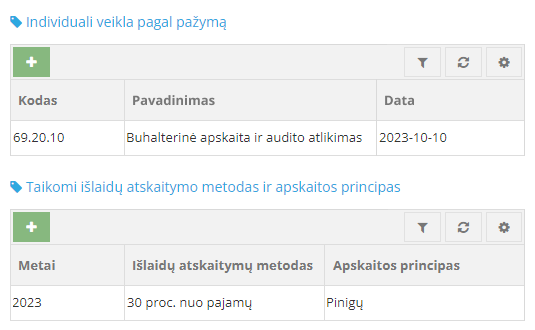

- Income and expense accounting register

- Easy transition to MB/UAB

- Convenient integrations

Convenient invoicing and accounting of individual activities:

Individual activity — independent commercial activity of a natural person. The requirement of binary entry is not applied to the accounting of individual activity, but the accounting of individual activity must be kept very carefully, because the person operating according to this form of activity should compensate accounting errors or losses with personal property.