Salary calculator 2024

More information:

- Salary amount:

On paper — the salary specified and calculated in the employment contract (before taxes are deducted);

In hand — the amount of wages payable to the employee after deducting GPM and social insurance contributions (after deduction of taxes). - Supplementary pension accumulation indicates whether the employee is saving for an additional part of the pension:

0% — the employee does not participate in the accumulation;

2.4% — an employee who participates in accumulation and pays 2.4% to pension funds;

3% — an employee who participates in accumulation and pays 3% to pension funds. - The tax-free amount of income (NPD) indicates the tax-free amount of income, depending on the amount of salary received and the available working capacity group:

Apply — NPD calculated from the salary is applied if the employee submits a request to the employer to apply;

Do not apply — NPD is not applied if the employee does not apply to the employer;

Specify — NPD is applied based on the level of work capacity, special needs or disability according to the certificate. - Employment contract can be:

Indefinite — the choice will affect only the rates of the employer's contributions to the Social Security;

Fixed term — the choice will affect only the rates of the employer's contributions to the Social Security. - Compulsory health insurance (CHI) — a system of personal health care and economic measures established by the state, which guarantees the provision of health care services and the payment of the costs of these services to persons covered by compulsory health insurance, in the event of an insured event.

6.98% — health insurance - State social insurance (NI) — State social insurance premiums - contributions to the State Social Insurance Fund in the amount prescribed by law, paid by insured persons and/or their insurers. Information about the beginning, end, and non-insurance periods of the insured persons' state social insurance.

13.97% — pension, unemployment and childcare insurance for employees who do not save in third-tier pension funds

15.52% — pension, unemployment and childcare insurance for employees saving in third-tier pension funds - Personal income tax (PIT) — Income of a resident from employment relationships or relationships corresponding to their essence (except for sickness, maternity, paternity, child care and long-term work benefits), benefits or remuneration for activities in the supervisory board or board, loan committee, paid instead of benefits or together with royalties, income received from a person related to the resident in employment relations or relations corresponding to their essence, according to copyright contracts, as well as from managers of small associations who are not members of those small associations according to the law on small associations, according to a civil (service) contract for management activities income received.

20% — annual share of income, not exceeding the amount of 60 average national wages

32% — annual share of income exceeding the amount of 60 average national wages

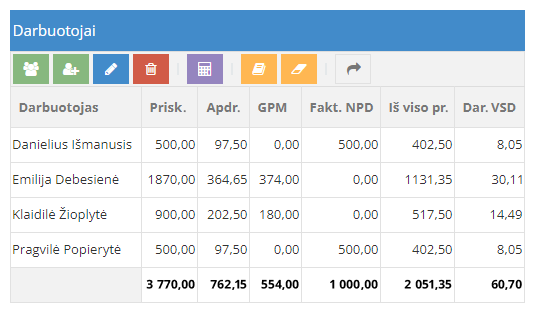

The payroll (DU) module is included in all paid plans

Payroll Module

Convenient payroll accrual and deduction:- Calculate salaries from 1 to 500+ employees;

- Total and non-total DU accounting is supported;

- Enter salaries manually for any period (tax changes from 2019);

- Calculate salaries for foreign capital companies;

- Calculate travel allowance automatically according to the order, once the daily allowance rates have been entered.

Payroll accounting easy and fast

Payroll documents — all paper or electronic documents related to wages: work schedule, time sheet (table), wage sheet (summary of credits), wage payment document (payroll).

Theory of wage calculation

Registering wages in the B1.lt program

You can find answers to the most frequently asked questions in the Encyclopedia:

Free accounting courses

The only free accounting courses in Lithuania prepared by qualified teachers

Accounting comics

The largest collection of accounting comics in Lithuania. Accounting that lifts Your spirits