FAQ / How to register fixed assets?

Ilgalaikį turtą į eksploataciją galima įvesti tik prekę iš sandėlio, t.y. turi būti įvestas ilgalaikio turto pirkimo dokumentas. Tik tada prekę kaip ilgalaikį turtą galima įvesti į eksploataciją.

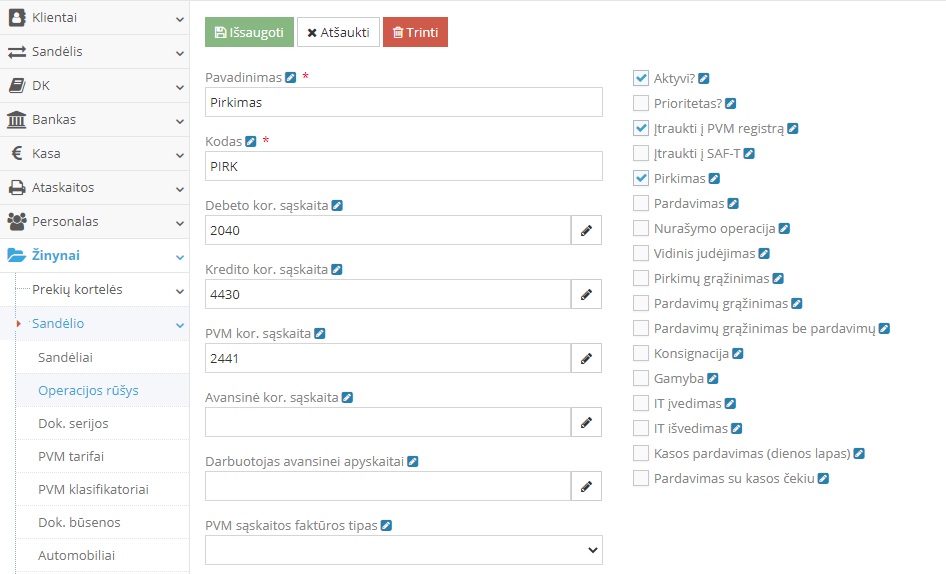

1. Sukurkite operaciją ilgalaikio turto įvedimui

Žinynai → Sandėlio → Operacijos rūšys

Modulyje spauskite žalią mygtuką „+“ sukurti naują įrašą. Sukurkite operaciją „Pirkimas“ su reikiamais nustatymais ir kor. sąskaitomis. Užpildžius laukus paspauskite mygtuką „Išsaugoti“. Jei tokia operacija sukurta, naujos operacijos kurti nereikia.

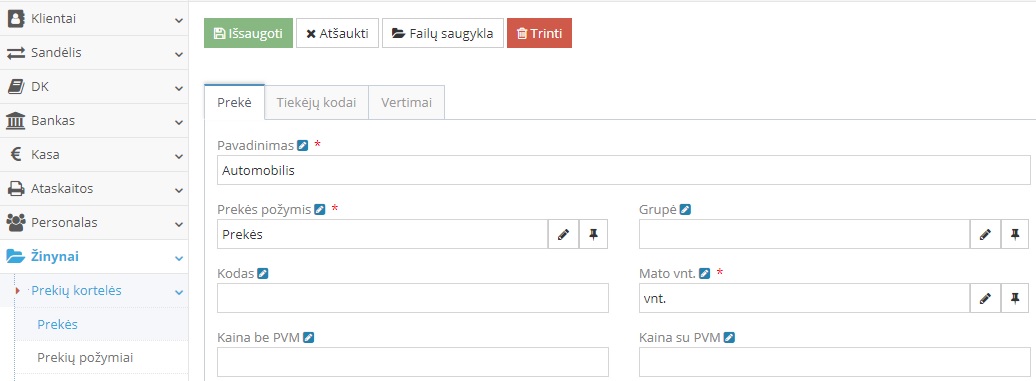

2. Sukurkite prekės kortelę

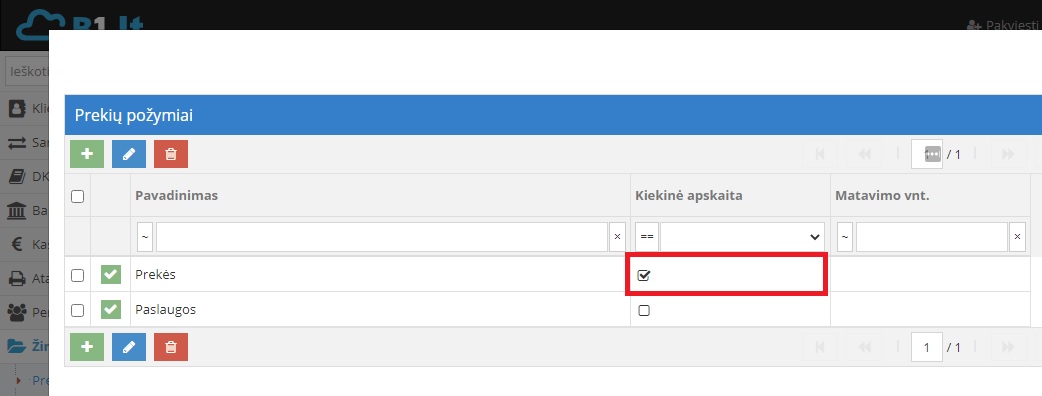

Sukurkite kortelę, pvz.: „Automobilis“ , prekės požymį pasirinkite „Prekės“ su pažymėta kiekine apskaita.

Prekės požymis

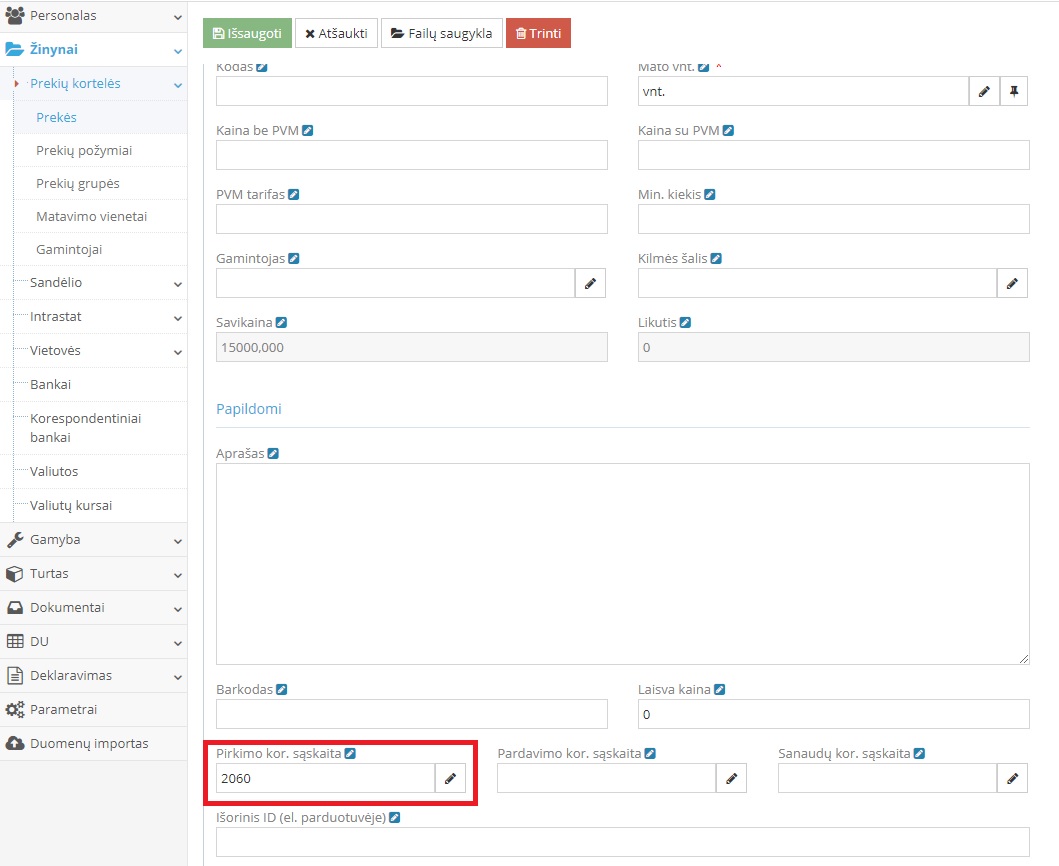

Laukelyje „Pirkimo kor. sąskaita“ įrašykite ilgalaikio įsigijimui naudojamą tarpinę kor. sąskaitą. Registruojant pirkimą debeto kor. sąskaitą programa paims iš prekės kortelės. Aprašę šiuos nustatymus, spauskite „Išsaugoti“.

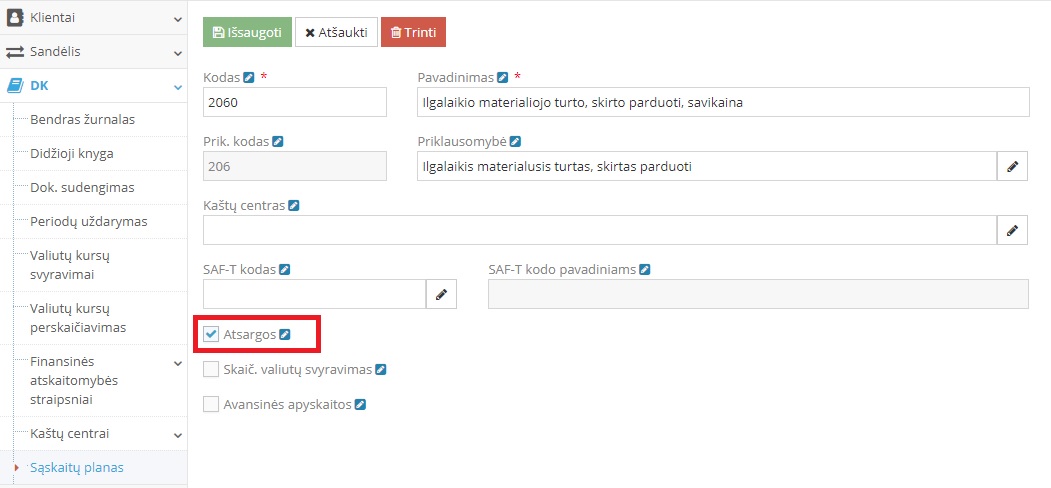

Pastaba. Jei naudojate tarpinę kor. sąskaitą 2060, būtinai patikrinkite sąskaitų plane ar ties šia kor. sąskaita yra priskirta varnelė.

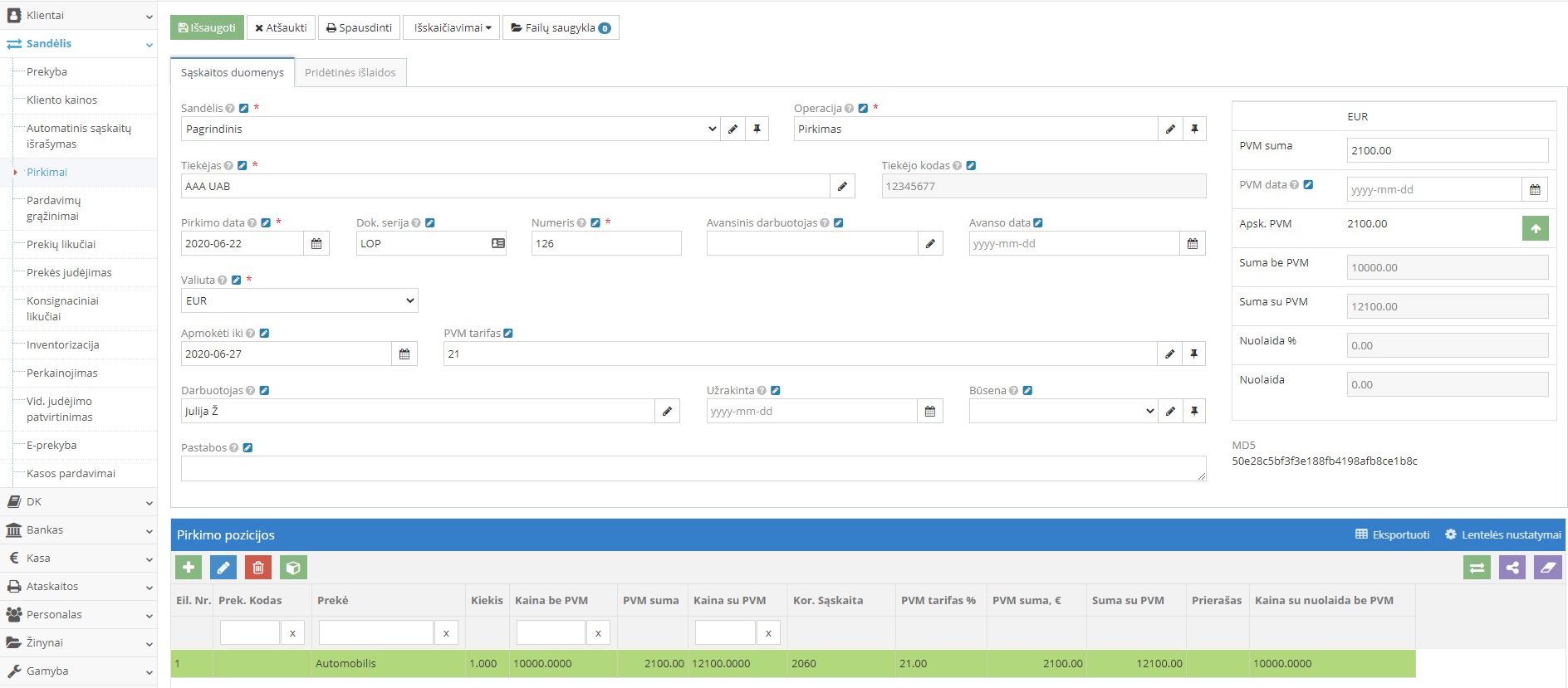

3. Užregistruokite ilgalaikio turto pirkimą

Sandėlis → Pirkimai

Modulyje sukurkite naują įrašą, paspauskite mygtuką „Pridėti naują įrašą“. Registruojant įrašą pasirinkite sandėlį ir operaciją „Pirkimas“, taip pat pasirinkite tiekėją arba sukurkite naują. Lentelėje „Pirkimo pozicija“ laukelyje „Prekė“ pasirinkite sukurtą prekę, t.y. automobilį ir nurodykite pirkimo sumą, už kiek ilgalaikis turtas buvo įsigytas. Įvedus paspauskite „Enter“ mygtuką, kad įrašas užsifiksuotų. Užregistravus dokumentą paspauskite mygtuką „Išsaugoti“.

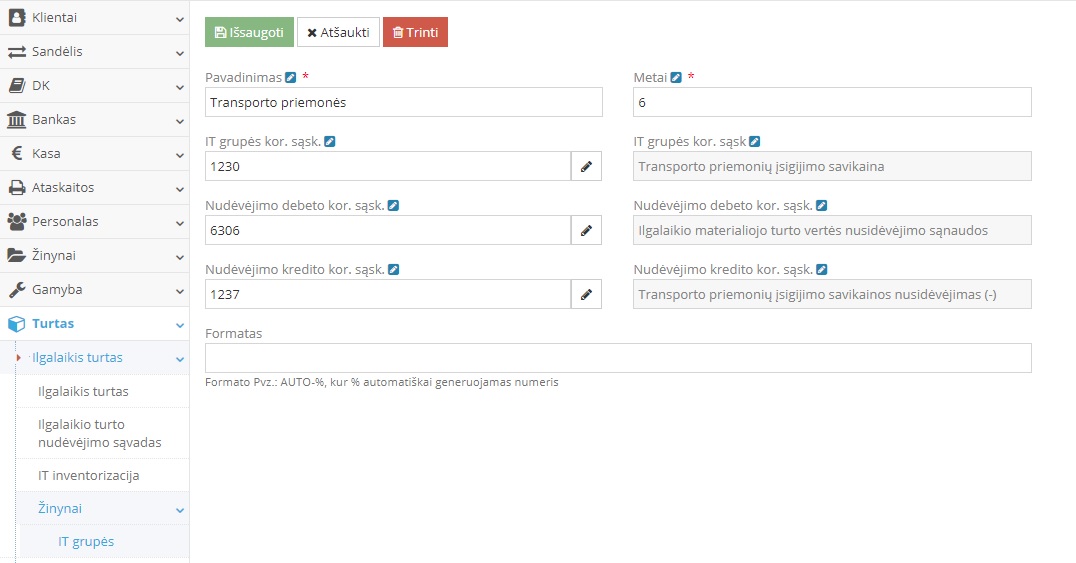

4. Sukurkite ilgalaikio turto grupes

Turtas → Ilgalaikis turtas → Žinynai → IT grupės

Grupės bus naudojamos kaip žinynas. Tuomet galėsite įvesti prekę į eksploataciją, skaičiuoti nusidėvėjimą ar atlikti inventorizaciją.

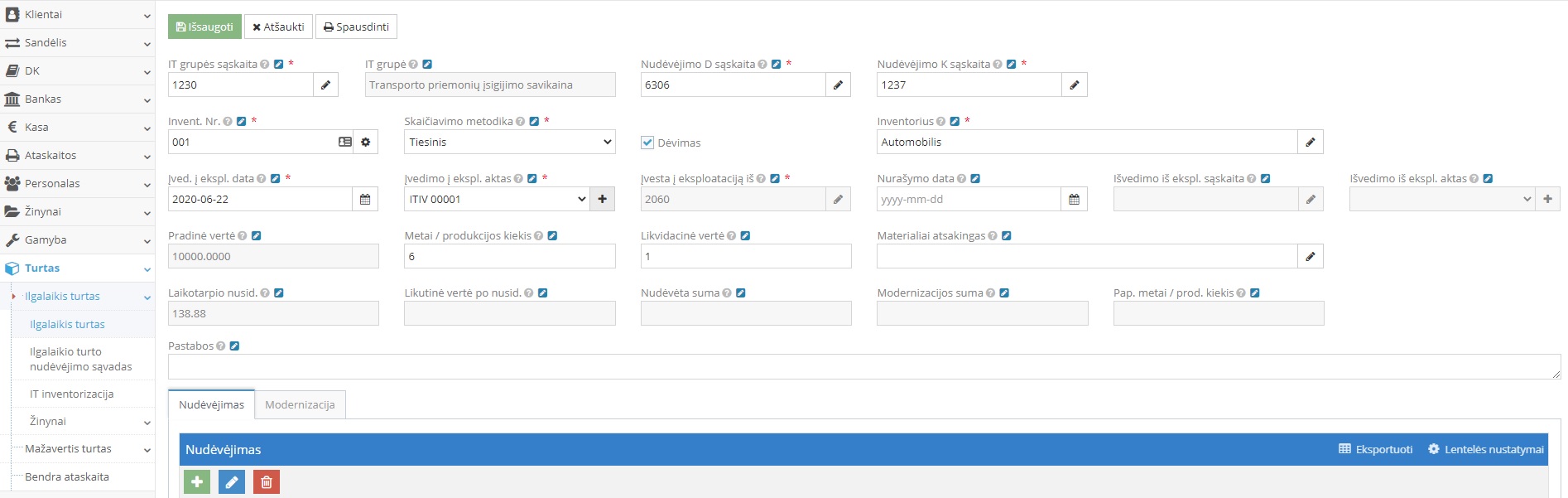

5. Ilgalaikio turto įvedimas

Turtas → Ilgalaikis turtas → Ilgalaikis turtas

Spauskite mygtuką „Pridėti naują įrašą“ ir įveskite ilgalaikį turtą. Atsidariusioje lentelėje užpildykite laukus:

- IT grupę, pasirinkus automatiškai bus užpildytos kor. sąskaitos;

- Inventoriaus Nr.;

- Pasirenkate kokia skaičiavimo metodika bus taikoma nudėvėjimo apskaičiavimui. Galimi keturi variantai: tiesiogiai proporcingas, dvigubas - mažėjančios kainos, produkcijos arba metų skaičiaus;

- Jei turtas dėvimas, uždėkite varnelę;

- Inventorius - iš likučių pasirenkamas ilgalaikis turtas;

- Nurodote įvedimo į eksploataciją datą. Pastaba, data negali būti nurodyta ankstesnė nei daikto įsigijimo data;

- Įvedimo į ekspl. aktas - paspauskite ant mygtuko „+“, tam, kad sukurtumėte aktą, t.y. iš sandėlio perkeliate į IT;

- Nurodykite kokia bus likvidacinė vertė.

Užpildžius laikus spauskite mygtuką „Išsaugoti“. Ilgalaikis turtas užregistruotas.